Widely used in the gambling community for sizing bets, the Kelly Strategy has proven to be an effective money-management tool for trading stocks.

Developing a viable trading strategy requires an effective money-management technique to maximize the long-term geometric wealth of a trading strategy. The strategy must have positive risk-adjusted expectancy for any money management to be additive. Kelly Criterion, a strategy has a positive expectancy will maximize the geometric growth in returns through the re-investment of profits or trade-to-trade compounding of returns. The Strategy defines a fixed fraction of capital to invest in each trade and is based on the

expectation (probability) of long-term capital growth.

Additional controls incorporated into the Kelly Calculator allow the user to vary the degrees of risk and return with built-in filters. Each strategy is automatically backtested to determine the best equity curve.

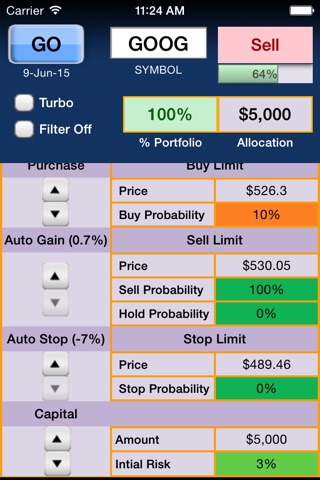

Trade Setup - Buy, Sell and Stop Limits and number of shares

Kelly % - Fixed percentage of capital

Capital Allocation - Fixed fraction of capital

Trade Quality - Positive trade percentage

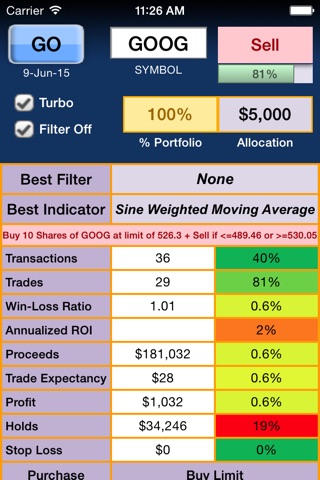

Best Filter - The filter that produces the best geometric growth

Best Indicator - The Moving Average that produces the best gain

Transactions - The number of Buy’s

Trades - The number of completed trades

Win-Loss Ratio - The Average Wins divided by the Average Losses

Annualized ROI - Rate of return for a given period that is less than one year

Proceeds - Period sales less expenses

Trade Expectancy - Expected period return

Profit - The period profit

Holds - Transactions not sold

Stop Loss - Stop limit sales

Premium or Discount Purchase - Purchase above or below the pivot point price

Gain - The expected transaction gain

Initial Risk - The potential loss